Click here to Quickly check your Business Loans Eligibility....

Click here to Quickly check your Business Loans Eligibility....

Loan Against Property eligibility depends upon various factors. A few of them are listed below:

Business Income:

Your income determines the amount of loan you are eligible for. Banks generally keep an EMI to Income ratio at 50% to 60%.

A stable business is preferred, meaning there should be signs of growth for the last 3 years. Sustained revenues and billing along with profit, act as cherry on top for loan applicants. If your total business experience exceeds 5 years along with good results in the stipulated tenure then that makes you a good business loan applicant.

For Business owners, income shown in Annual Income tax returns is usually considered. There are other income eligibility calculation methods also like Gross Turnover, Banking Surrogate, Existing EMI track record, GST method and so on.

Existing Loans:

In case you are paying EMIs on existing loans, then the Business Loans eligibility amount will come down to keep the EMI to income ratio at 50% to 60%.

Credit History:

Banks also check credit history of a borrower from CIBIL which stands for Credit Information Bureau India Ltd. It is a repository of information, which contains the credit history of commercial and consumer borrowers. CIBIL provides this information to its members in the form of credit information reports. Individuals can also access their own credit reports from CIBIL. For more information refer www.cibil.com

Generally a Credit Score of 700 & above is considered GOOD. Many Banks these days are following CIBIL Score based Interest Rates, which means - Better your CIBIL Score, Better Interest Rate you will get!

To check your Cibil Score & get Report click here...

How do I know my eligibility? - Click Here

If you want a call back regarding Business Loans - Click Here

Purpose:

Purpose:

Secured Business Loans:

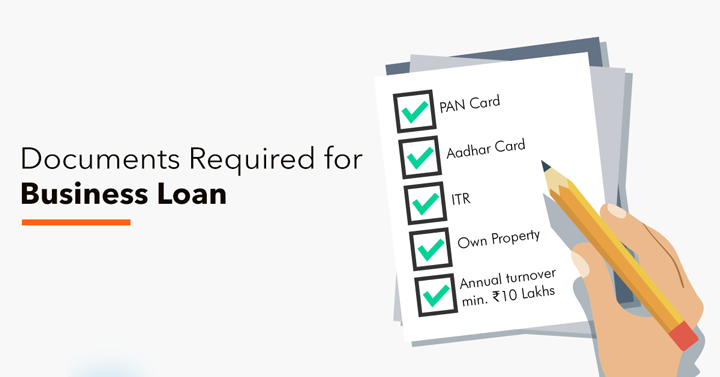

Secured Business Loans: Various types of documents are required to submitted for a Business Loan Application:

Various types of documents are required to submitted for a Business Loan Application: Interest and other charges paid towards a Business Loan is a usual business expenditure and is allowed as a deduction from the borrower’s business income while filing his Income tax returns.

Interest and other charges paid towards a Business Loan is a usual business expenditure and is allowed as a deduction from the borrower’s business income while filing his Income tax returns. Acquiring a Business Loan doesn’t only involve the monthly interest but it also includes other charges and fees at various stages of taking the Business Loan. You must consider all these charges while comparing the cost structure across banks. Following is the detailed fee structure incurred by banks at different loan stages:

Acquiring a Business Loan doesn’t only involve the monthly interest but it also includes other charges and fees at various stages of taking the Business Loan. You must consider all these charges while comparing the cost structure across banks. Following is the detailed fee structure incurred by banks at different loan stages: